City College Faces Short-Term Surplus, Long-Term Budget Crisis

The college is tightening student verification and considering policy changes, but leaders stress that without increased enrollment or new state assistance, difficult decisions lie ahead.

By Tabari Morris

City College will end the budget year with a little more funds on hand, but school officials anticipate major money woes down the line. The college is facing fewer students, uncertain state budgets and the lingering impacts of fraudulent student enrollments.

In the final months of the 2024-2025 fiscal year, the college's finance team organized funds and obtained some refunds. This resulted in a slightly larger surplus than anticipated.

“That surplus will end up being a little greater than we anticipated, which is great. We want these funds for the future,” Interim Chancellor Mitch Bailey said. Bailey referred to successful efforts to recover funds for administrative expenses and healthcare for part-time faculty.

Despite the healthy year-end balance, the projections for subsequent years are alarming. The college is projecting a shortfall of $800,000 for the fiscal year 2025-2026, which could escalate to $5–6 million for 2026-2027 and extend to $9 million by fiscal year 2027-2028 if no measures are implemented.

These shortfalls are exacerbated by financial instability throughout the state, including the impact of intense fires throughout Los Angeles County. The fires are causing property tax collections, a key source of funding for education under Proposition 98, to fall behind schedule, and will likely impact state education budgets over the next few years.

One trustee stated that 20% to 30% of Prop 98 funding derives from Los Angeles property tax money alone. The reassessment of the burned properties will reduce education funds for the whole state in the future.

The state-level funding City College receives is calculated by the Student Centered Funding Formula (SCFF). The formula calculates funds for a community college based on a number of factors, such as the number of students enrolled and completion of degrees.

Currently, the college’s state revenue is in part made up of cost-of-living adjustments, also known as COLAs, through the “Hold Harmless” safety net provision. Hold Harmless allows a window of time during which a college can recover its enrollment before funding is recalculated based on enrollment.

Next year, Hold Harmless will end, which spells an end for the COLAs. Without the cost-of-living adjustments, that state revenue portion will be frozen at a fixed level that cannot keep pace with the annual increases in operating expenses and the rate of inflation.

The immediate future appears promising, with revenues managing to exceed expenditures by the end of the year. However, administrators caution that if enrollment does not grow or if there is no additional state assistance, the college will be forced to make difficult decisions to remain financially stable.

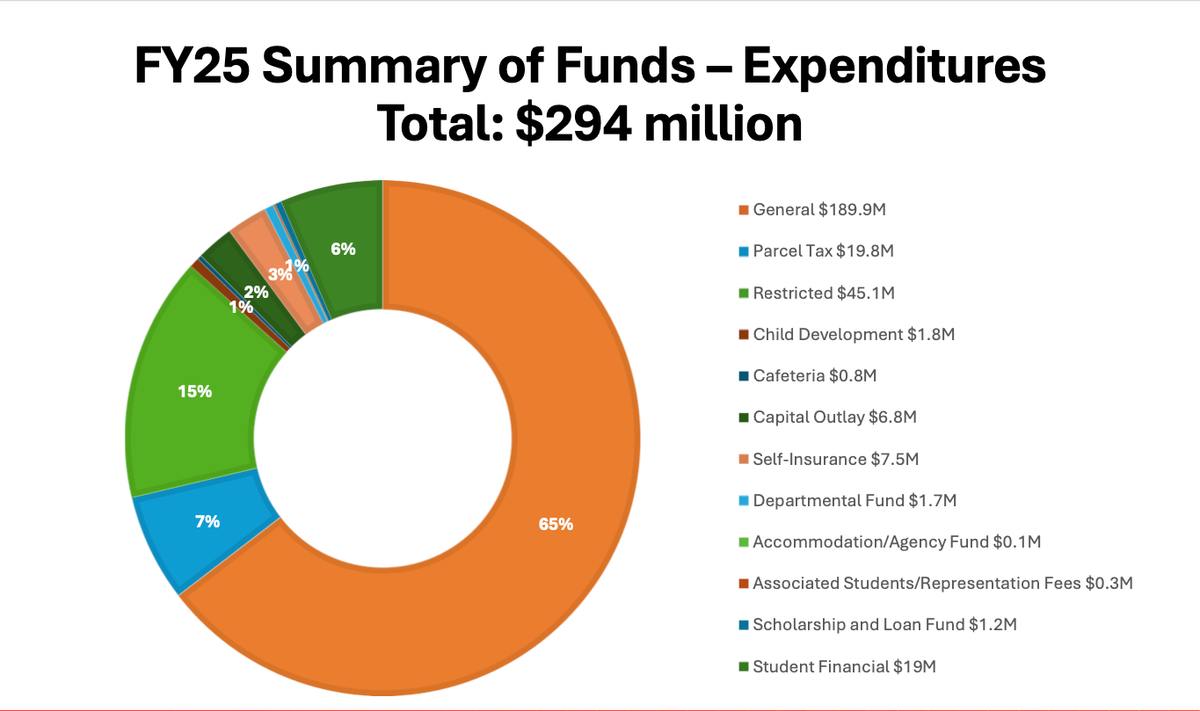

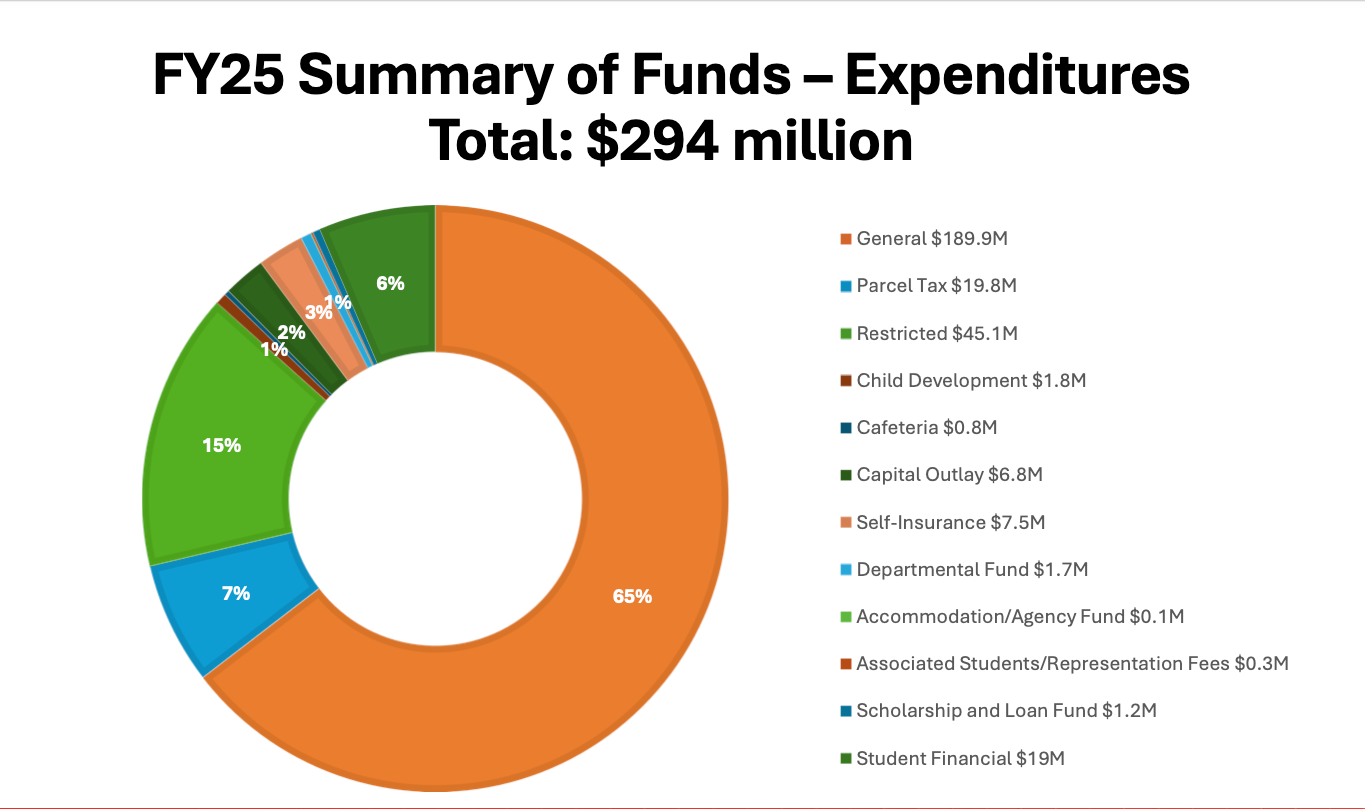

“We can do anything we want with $300 million; we simply can't do everything we want with $300 million,” Bailey said. The financial strategies mentioned by Bailey involve enhancing courses to address specific needs and resources, examining the college's organizational structure, and determining if programs are financially viable in the long run.

Representatives from the faculty union, AFT2121, have been adamant in their belief that the current college administration lacks a strong financial vision for the college. Citing observations of lackluster approaches to dealing with enrollment issues, such as “ghost students” and the inability to meet student demand for prerequisite classes like English 1A.

“The state will allow you to recover full funding for your previous level of enrollment if you can do it within a certain timeframe, and that timeframe expires at the end of next year,” said Robin Pugh, Vice President of AFT2121.

“A small investment in enrollment for next year could’ve made the difference of two or three years in terms of how long we're stuck in that frozen funding position. And yet the administration so far hasn't changed what they're doing at all. They're doing the exact same thing enrollment-wise that they were doing last year,” Pugh said.

Eventually, the college will return to a student-centered funding formula, but the concern is that it has missed its last opportunity to make a significant increase in enrollment under the Hold-Harmless provision, considering the state can only afford to accommodate gradual increases each year.

Now faced with an $800,000 deficit next year, the college will have to make difficult decisions to stay afloat. Bailey has said it himself many times before: He is not Willy Wonka, and he will not sugar-coat the realities of the college's financial situation.

“It's not just about chasing the money, because we have to live within our means. And any new resources we get, we have to be strategic about how we're going to deploy those resources,” Bailey said.